RSA retail savings bonds review

RSA Retail Bonds are bonds issues by the government to private individuals

in order to encourage savings. But, how do they work? Are they safe? How do

they compare to other fixed deposits?

What is the interest rate on RSA Retail bonds?

You can get 10% interest when investing in the 5 year RSA retail bond. This

is a fixed rate and does not change throughout the term. You can have

interest paid out monthly (if you are over 65), semi-annually or at expiry.

| Term | Fixed |

|---|

| 2 year | 7.5% |

| 3 year | 8% |

| 5 year | 8% |

last updated 15th February 2026

You can get inflation plus 4% if you invest in the RSA retail inflation linked

bond. The inflation linked bonds keep pace with inflation. So your interest

payouts will increase year-on-year as consumer price inflation increases. When

investing you want to prevent loss of purchasing power. Inflation linked bonds

are a way of ensuring your money does not lose its purchasing power over time.

What are the interest rates offered on RSA inflation linked bonds?

| Term | Inflation linked |

|---|

| 3 year | 2.75% |

| 5 year | 3% |

| 10 year | 4% |

last updated 15th February 2026

Source: National treasury website

What are RSA Retail bonds?

Here are the most important features of RSA Retail bonds.

Issued by Government. SA Retail bonds are

offered by the SA government to South African citizens. They were launched

in 2004 to encourage savings.

Only South African private individuals can invest. You have to be a South African citizen to qualify. No companies or trusts

invest in them.

Minimum investment is R1000. Maximum investment

is R5m for any individual.

No charges, commissions or costs are associated with them.

Investment options. You can choose to invest in

fixed rate bonds or a bond linked to inflation.

Terms available. 2-, 3- or 5-year terms are available

for fixed rate bonds. Whereas the inflation-linked bonds offer 3-, 5- or 10-year

terms.

Interest payouts. You can choose to have interest

paid out every six months or at maturity of the bond. Individuals over 60 are

allowed to have interest paid out monthly.

Rates offered. The rates _on offer_ are reviewed

by National Treasury every month. So these can change on a monthly basis. Importantly

- just like fixed deposits - the interest rate you get is the one you agreed

to invest in at the start of your investment. This is locked and guaranteed throughout

the investment period. If rates were to fall, you will still get the same rate

agreed to at the start of your investment.

RSAs offer a restart feature. This is a great

feature of RSAs. If rates were to go higher, they offer the option of restarting

the investment with the higher rate. Take note of this! Your bank's fixed deposit

does not allow for this.

Here is an example. Let us assume you invested in

the five year fixed rate bond. Three years later, rates increase by 2%. The restart

feature allows you to restart your investment to make use of the higher rates

on offer. You can choose to restart your investment in any of the available terms.

So you could reinvest in the 2 year fixed rate bond. No penalties or costs are

associated with this. However, you must have been invested for at least 12 months

to make use of the restart feature.

Withdrawals. Full or partial withdrawals are allowed

after the bond has been held for one year. However, a penalty of one interest

payment will be applied.

Withdrawals prior to 12 months. Early withdrawal

requests can be made even if you are invested for less than 12 months. However,

these are honored at the discretion of National Treasury. "Extraordinary circumstances"

will have to apply. You will need to fill out a form - see

here

- and provide the reasons for the extraordinary change in your circumstance in

order to qualify for the withdrawal.

What are the disadvantages of RSA retail bonds versus fixed deposits offered

by banks?

#1 Customer service. Whilst I have had good experience

dealing with the RSA retail bonds operations team at the National treasury, others

have not had the same experience. This is a government run institution and so

you can certainly expect response times.

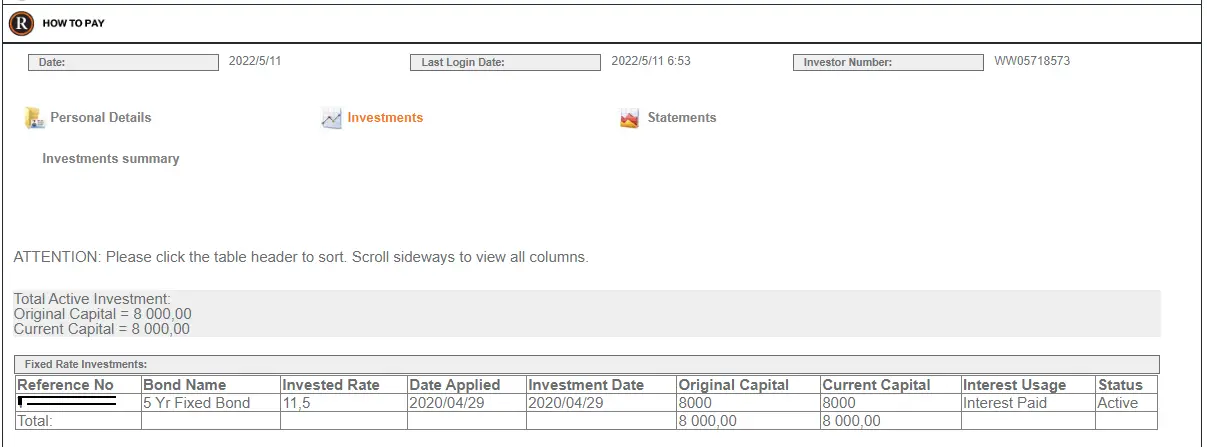

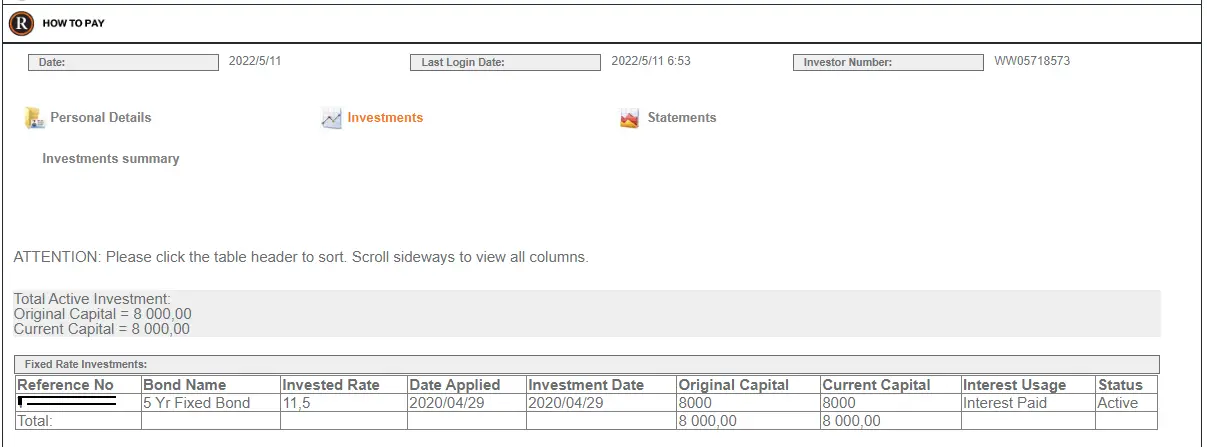

#2 No app & website user experience is not as good. The banks constantly update their websites and apps to ensure their clients

get the best user experience. They are competing with each other. The national

treasury website does not have the same user experience. The website looks like

it came from the 90s and there is certianly no iPhone or Android app. See

Picture of National treasury website client portal

Picture of National treasury website client portal

Are RSA retail bonds riskier than fixed deposits offered by banks?

No. The probability of the SA government failing to pay its local debt taken

up by their own citizens (ie RSA retail bonds) is lower than a retail bank

failing to pay their debt. Whilst we have had governments fail to pay debt

in the past - look at Argentina or Russia - this was notably on their USD

denominated debt. This was debt not denominated in the home currency and was

held mainly by foreign investors. Argentina and Russia were unable to pay

this debt due to large depreciation of their own currency. Bottom line:

Whilst any investment has a risk attached to it, the risk of the government

defaulting on your RSA retail bond investment is too small to worry about.

How can you invest in RSA retail bonds?

The easiest is to sign up on their website at

secure.rsaretailbonds.gov.za  Picture of National treasury website client portal

Picture of National treasury website client portal